|

| |

|

Polson Bourbonniere Financial

Planning Group Inc.*

DWM Securities Inc.

100 - 7050 Woodbine Ave.

Markham, Ontario L3R 4G8

Tel: 416.498.6181 or 905.413.7700

Toll Free: 1.800.263.0120

Fax: 905.305.0885 info@pbfinancial.com

www.worryfreeretirement.com

Ruth Ashton, CFP®

Certified Financial Planner

Investment Advisor

Phone: (905) 413-7710 rashton@pbfinancial.com

Paul Bourbonniere, CFP®, CLU, CH.F.C.

Certified Financial Planner

Investment Advisor

Phone: (416) 498-6181 pbourbonniere@pbfinancial.com

Lydia Bzowej, BA, CFP®, EPC

Certified Financial Planner

Investment Advisor

Phone: (905) 413-7703 lbzowej@pbfinancial.com

Allan Kalin, CFP®

Certified Financial Planner

Investment Advisor

Phone: (905) 413-7706 akalin@pbfinancial.com

Derek Polson , CFP®

Certified Financial Planner

Investment Advisor

Phone: (905) 413-7709 dpolson@pbfinancial.com

Kirk Polson, CFP®, CLU, CH.F.C.

Certified Financial Planner

Investment Advisor

Phone: (416) 498-6181 kpolson@pbfinancial.com

Office Hours

Monday to Friday,

8:30 a.m. - 5:00 p.m. |

| |

|

|

|

|

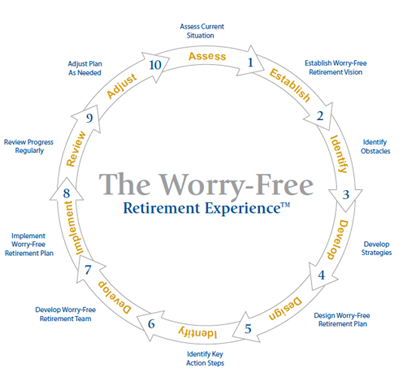

As you can see from the chart, we have developed a unique 10-step financial planning process as part of The Worry-Free Retirement Experience™. This exceeds the 6-step process endorsed by Advocis, and is tailored to your specific needs and objectives.

Financial security is just one factor in a successful retirement. Money does, however, significantly influence many other factors such as your ability to handle the transition from “work” to the next stage of your life. Planning begins by reflecting on what we call “your vision”.

| If we were meeting here three years from today — and you were to look back over those three years to this day, what has to happen over that time, both personally and professionally, for you to feel happy about your progress? |

In our opinion, all too often we see advertising by financial institutions focusing on the massive retirement nest egg required 20 or 30 years down the road. This only serves to discourage most of us — we throw our hands up in the air unable to relate to the amount of money that needs to be saved, the time frame, and the trade off between today’s needs and tomorrow’s goals. By initially focusing on the next three years, we can assist you in developing a vision of where your want to be in the near term — goals that are both measurable and attainable.

|