|

| |

|

Polson Bourbonniere Financial

Planning Group Inc.*

DWM Securities Inc.

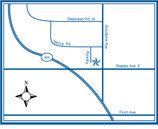

100 - 7050 Woodbine Ave.

Markham, Ontario L3R 4G8

Tel: 416.498.6181 or 905.413.7700

Toll Free: 1.800.263.0120

Fax: 905.305.0885 info@pbfinancial.com

www.worryfreeretirement.com

Ruth Ashton, CFP®

Certified Financial Planner

Investment Advisor

Phone: (905) 413-7710 rashton@pbfinancial.com

Paul Bourbonniere, CFP®, CLU, CH.F.C.

Certified Financial Planner

Investment Advisor

Phone: (416) 498-6181 pbourbonniere@pbfinancial.com

Lydia Bzowej, BA, CFP®, EPC

Certified Financial Planner

Investment Advisor

Phone: (905) 413-7703 lbzowej@pbfinancial.com

Allan Kalin, CFP®

Certified Financial Planner

Investment Advisor

Phone: (905) 413-7706 akalin@pbfinancial.com

Derek Polson ,CFP®

Certified Financial Planner

Investment Advisor

Phone: (905) 413-7709 dpolson@pbfinancial.com

Kirk Polson, CFP®, CLU, CH.F.C.

Certified Financial Planner

Investment Advisor

Phone: (416) 498-6181 kpolson@pbfinancial.com

Office Hours

Monday to Friday,

8:30 a.m. - 5:00 p.m. |

| |

|

|

|

|

| The Worry-Free Retirement Experience™ |

|

One of our objectives is to help our clients better understand our complete array of services and capabilities. In discussions with our clients, a common theme emerged, whether the person was 25 or 75 years of age. Everyone had the ultimate goal of meeting their financial needs and enjoying a worry-free retirement. While the actual definition of “retirement” varied greatly, the idea of a stage in life where your savings and investments are sufficient to allow you to do what you want to do, not what you have to do, had great appeal. Thus we created The Worry-Free Retirement Experience™.

The Worry-Free Retirement Experience™ will help you develop a financial plan so you can experience a retirement free from financial stresses and concerns. Created by the retirement experts at Polson Bourbonniere, The Worry-Free Retirement Experience™ will help you to achieve a level of retirement income to enjoy life and to realize your legacy dreams for your family.

Once retired, most people have a comfortable lifestyle, but they often have nagging doubts. They worry that they may not have enough money for all of their retirement years. They may be paying too much tax, and they may not be getting the best returns on their investment. As well, they may not be sure how to leave a financial legacy to their family and community. All of these doubts, concerns and worries don’t allow them to enjoy their retirement to the fullest. That’s why we created The Worry-Free Retirement Experience™ — to help you experience a worry-free retirement.

The Worry-Free Retirement Experience™ is a 10-step process divided into three stages. In stage one, we help you assess your current situation and set personal and financial goals. Working together in stage two, we help you develop strategies and a Worry-Free Retirement Plan. In stage three, your Worry-Free Retirement Team will help you implement your plan.

We developed this process working with hundreds of clients, of all ages, during the past twenty years. We help them understand their current situation and develop a vision for a worry-free retirement. Then we identify the obstacles standing in their way, and develop strategies to overcome those obstacles. We also review all of the tools — both financial and otherwise — which help them realize their vision. This process gives our clients more confidence and peace of mind during retirement.

To help you get started with our process, you participate in a one-on-one session with us. During the session, you work with us through the first few steps of our process.When you’ve completed the session, you’ll be ready to participate in the Worry-Free Retirement Program designed to help you develop and implement your Worry- Free Retirement Plan. You can also take advantage of The Worry-Free Retirement System, our full suite of tools and capabilities.

When you’ve completed The Worry-Free Retirement Experience™, you’ll have more peace of mind. You’ll have a comprehensive financial plan in place. You’ll know you won’t run out of income. You’ll be prepared for any financial emergency. You’ll be paying less tax, and have an estate plan in place that matches your wishes. And most importantly, you’ll be experiencing a worry-free retirement. |