|

| |

|

Polson Bourbonniere Financial

Planning Group Inc.*

DWM Securities Inc.

7050 Woodbine Ave., Suite 100

Markham, Ontario L3R 4G8

Main: 416.498.6181 or 905.413.7700

Fax: 905.305.0885

Toll Free: 1.800.263.0120

Website: www.worryfreeretirement.com

Ruth Ashton, CFP®

Certified Financial Planner

Investment & Insurance Advisor

Direct: (905) 413-7710

E-mail: rashton@pbfinancial.com

Paul Bourbonniere, CFP®, CLU, CH.F.C.

Certified Financial Planner

Investment & Insurance Advisor

Direct: (416) 498-6181

E-mail: pbourbonniere@pbfinancial.com

Lydia Bzowej, BA, CFP®, EPC

Certified Financial Planner

Investment & Insurance Advisor

Direct: (905) 413-7703

E-mail: lbzowej@pbfinancial.com

Allan Kalin, CFP®

Certified Financial Planner

Investment & Insurance Advisor

Direct: (905) 413-7706

E-mail: akalin@pbfinancial.com

Derek Polson, CFP®

Certified Financial Planner

Investment & Insurance Advisor

Direct: (905) 413-7709

E-mail: dpolson@pbfinancial.com

Kirk Polson, CFP®, CLU, CH.F.C.

Certified Financial Planner

Investment & Insurance Advisor

Direct: (416) 498-6181

E-mail: kpolson@pbfinancial.com

Office Hours

Monday to Friday,

8:30 a.m. - 5:00 p.m. |

| |

|

|

|

|

Lydia Bzowej, BA, CFP®, EPC

Changes to CPP benefits were introduced in December 2009 and began taking effect in 2011. With the changes to OAS, this is a good time to review the CPP amendments from the last few years.

Changes to CPP benefits were introduced in December 2009 and began taking effect in 2011. With the changes to OAS, this is a good time to review the CPP amendments from the last few years.

Here are the CPP changes already in place:

- If you decide to begin CPP payments prior to age 65 but continue to work, you and your employer will both need to continue contributing to CPP. These contributions are applied to increase your CPP benefits effective January 1 of the year following the contribution.

- You can now collect CPP benefits immediately after you retire without any work interruption.

- If you are between the ages of 65 to 70, are receiving CPP benefits, and are still working, then you can choose to contribute to CPP which will increase your pension the following year.

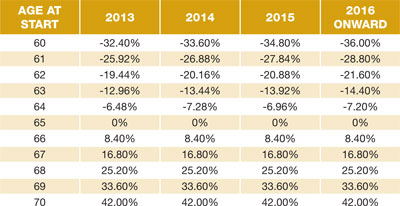

- If you start your CPP benefits after age 65, your monthly pension will increase by 0.7% per month (8.4% per year). If you wait until age 70 to start collecting CPP benefits, then your monthly amount will be 42% higher than at age 65.

- If you start your CPP benefits prior to age 65, your monthly pension will decrease by a larger percentage than in the past. These changes are still being phased in and will be completed by 2016. See the chart below for details.

Please contact your Polson Bourbonniere Certified Financial Planner if you would like to discuss these changes and how they may impact your retirement.

|